By Martin Crutsinger, Associated Press

Updated

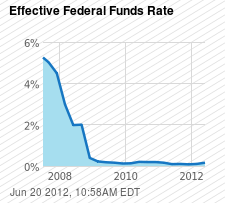

WASHINGTON The Federal Reserve is extending a program intended to further lower long-term interest rates, noting that hiring has weakened, consumer spending is rising slowly and the economy needs more support.

By J. Scott Applewhite, AP/File

Federal Reserve Board Chairman Ben Bernanke testifies on Capitol Hill.

By J. Scott Applewhite, AP/File

Federal Reserve Board Chairman Ben Bernanke testifies on Capitol Hill.

Stocks slumped after the announcement. Wall Street had rallied Tuesday on hopes that the Fed would announce that more help is on the way. The Dow Jones industrial average climbed 95.51 points to its highest close in a month.

The Fed said it will continue what's called Operation Twist through the end of the year. It had been scheduled to end this month. Chairman Ben Bernanke will take questions about the economy and the Fed's action at a press conference at 2:15 p.m. ET

The Fed has been selling $400 billion in short-term Treasurys since September and buying longer-term Treasurys. It says it will shift another $267 billion through December. The Fed wants to spur more borrowing, spending and growth.

But extending Operation Twist might not provide much benefit. Long-term U.S. rates have already touched record lows. Businesses and consumers who aren't borrowing now might not do so if rates slipped slightly more.

Data by YCharts

Fed officials are also reiterating their plan to keep short-term rates at record lows until at least late 2014. They also repeated a warning that Europe's financial crisis continued to pose a significant risks to the economy.

The Fed has more leeway to act because it says inflation has declined. It pointed to lower gas and oil prices.

The statement was approved on a 11-1 vote. Jeffery Lacker, president of the Richmond Regional Fed Bank, dissented for the fourth straight meeting. The statement said he opposed the continuation of Operation Twist.

The recovery has slowed this spring. U.S. employers added just 69,000 jobs in May. Since averaging a healthy 252,000 a month from December through February, job growth has slowed to a lackluster average of 96,000 over the past three months.

In extending Operation Twist, the Fed seeks to "twist" long-term rates lower relative to short-term rates. Operation Twist has the advantage of potentially lowering long-term rates without expanding the Fed's record-high portfolio. When the Fed expands its portfolio of investments, critics argue that it raises the risk of high inflation later.

Copyright 2012 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

For more information about reprints & permissions, visit our FAQ's. To report corrections and clarifications, contact Standards Editor Brent Jones. For publication consideration in the newspaper, send comments to [email protected]. Include name, phone number, city and state for verification. To view our corrections, go to corrections.usatoday.com.

USA TODAY is now using Facebook Comments on our stories and blog posts to provide an enhanced user experience. To post a comment, log into Facebook and then "Add" your comment. To report spam or abuse, click the "X" in the upper right corner of the comment box. To find out more, read the FAQ and Conversation Guidelines.

Tags for this Thread

+ Reply to Thread

Results 1 to 1 of 1

-

06-20-2012, 01:32 PM #1

Fed extends Operation Twist to lower long-term rates - USA TODAY

Fed extends Operation Twist to lower long-term rates - USA TODAY

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Reply

Reply

Bookmarks